Psychology of Cheap Coins

There is a possibility that Bitcoin will undergo a major rebranding in the near future due to the hysteria that often surrounds cheap coins. In this article, we’ll explore the psychological attraction of cheap coins and how a rumored Bitcoin rebrand could increase its market cap by billions.

What do many of the coins currently going through insane pumps have in common? Tommy Wiseau may have said it best in the following clip:

They are cheap cheap cheap cheap. Well, at least psychologically they are. It’s much harder to say if these coins are truly overvalued or undervalued. However, there’s a long history of the psychological effect of stock splitting and the cheaper price leading to more investors and an increased market cap.

According to YourArticleLibrary, “As the price of a share gets higher and higher some investors may feel the prices are too high for them to buy or small investors may feel it is unaffordable. Splitting the share brings the share price down to a more attractive level. Thus, the effect is psychological. The actual value of the share does not change one bit, but the down share price may attract the new investors .”

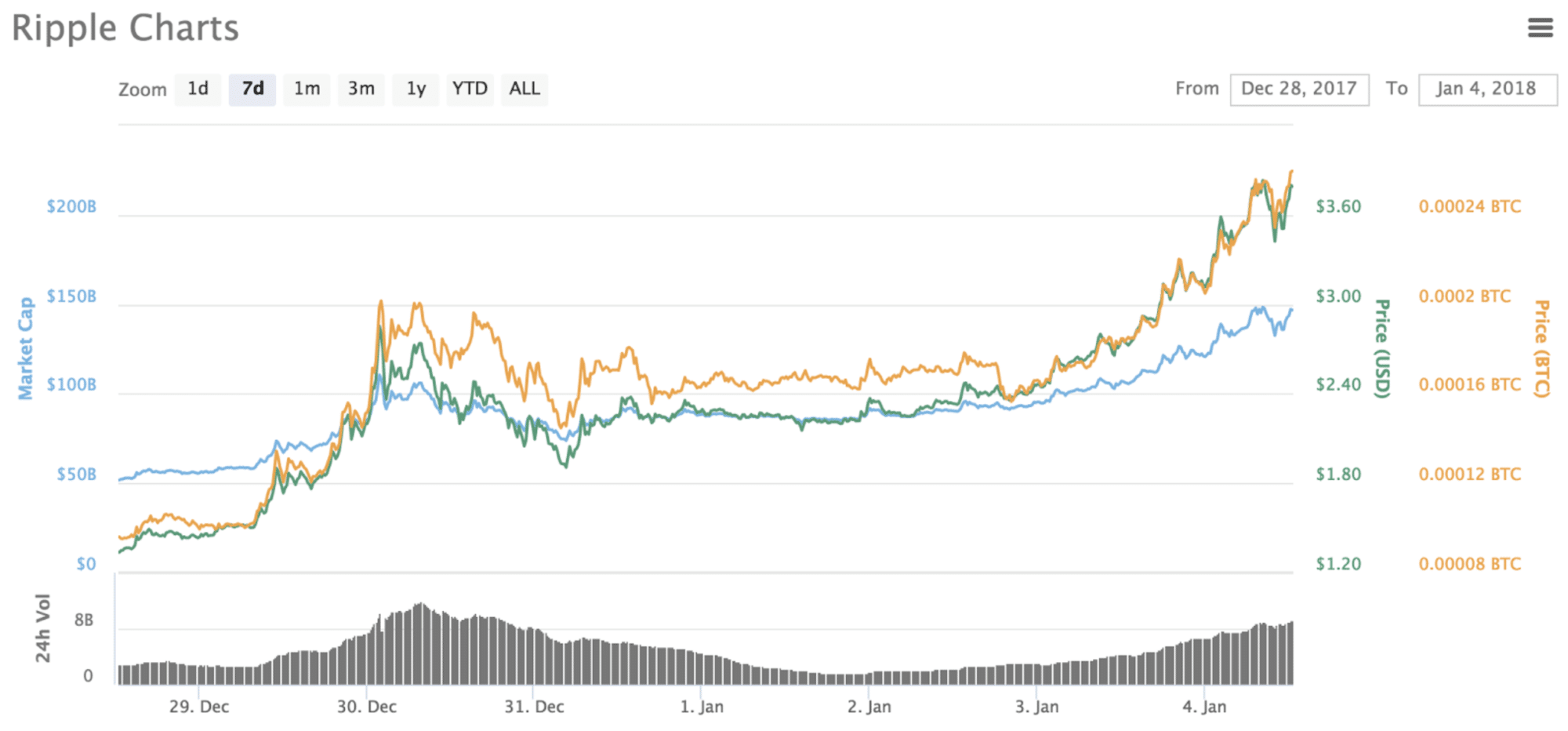

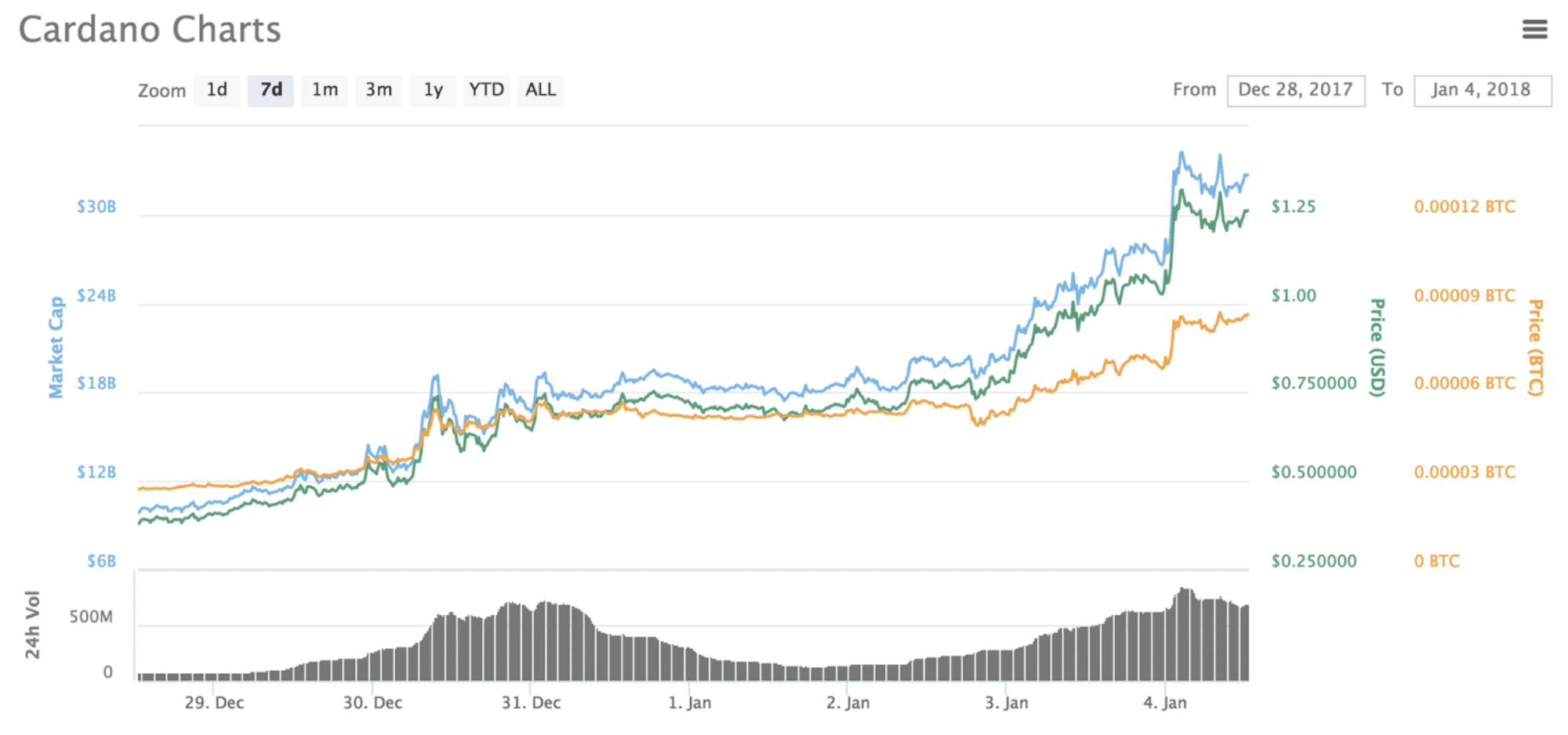

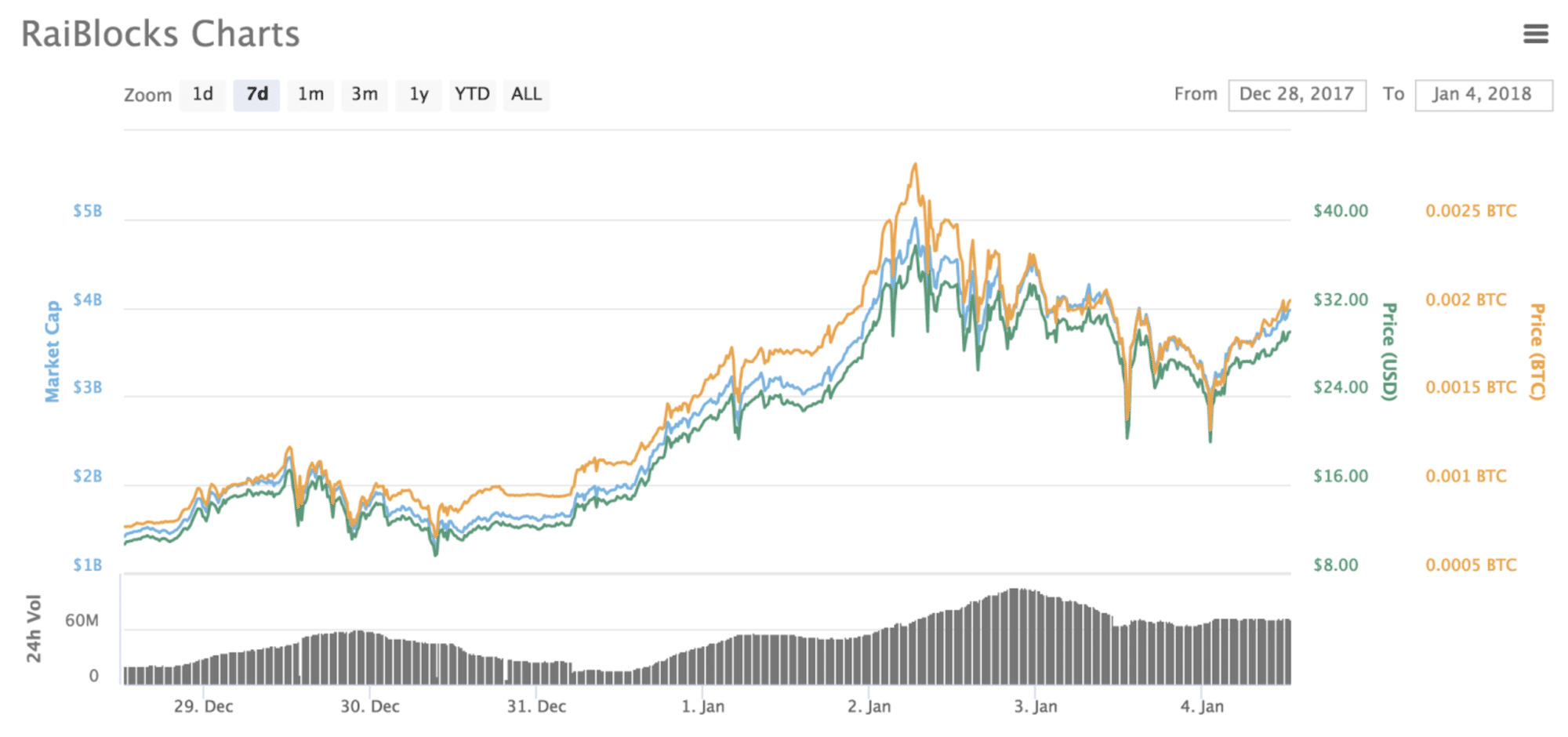

Are these new coins with circulating supplies in the billions taking advantage of this? It’s the opinion of some that there has been a rise in the “cheap” coins. Cheap meaning around the price of a dollar or less. Take a look at the charts of these various cheap coins over the past week.

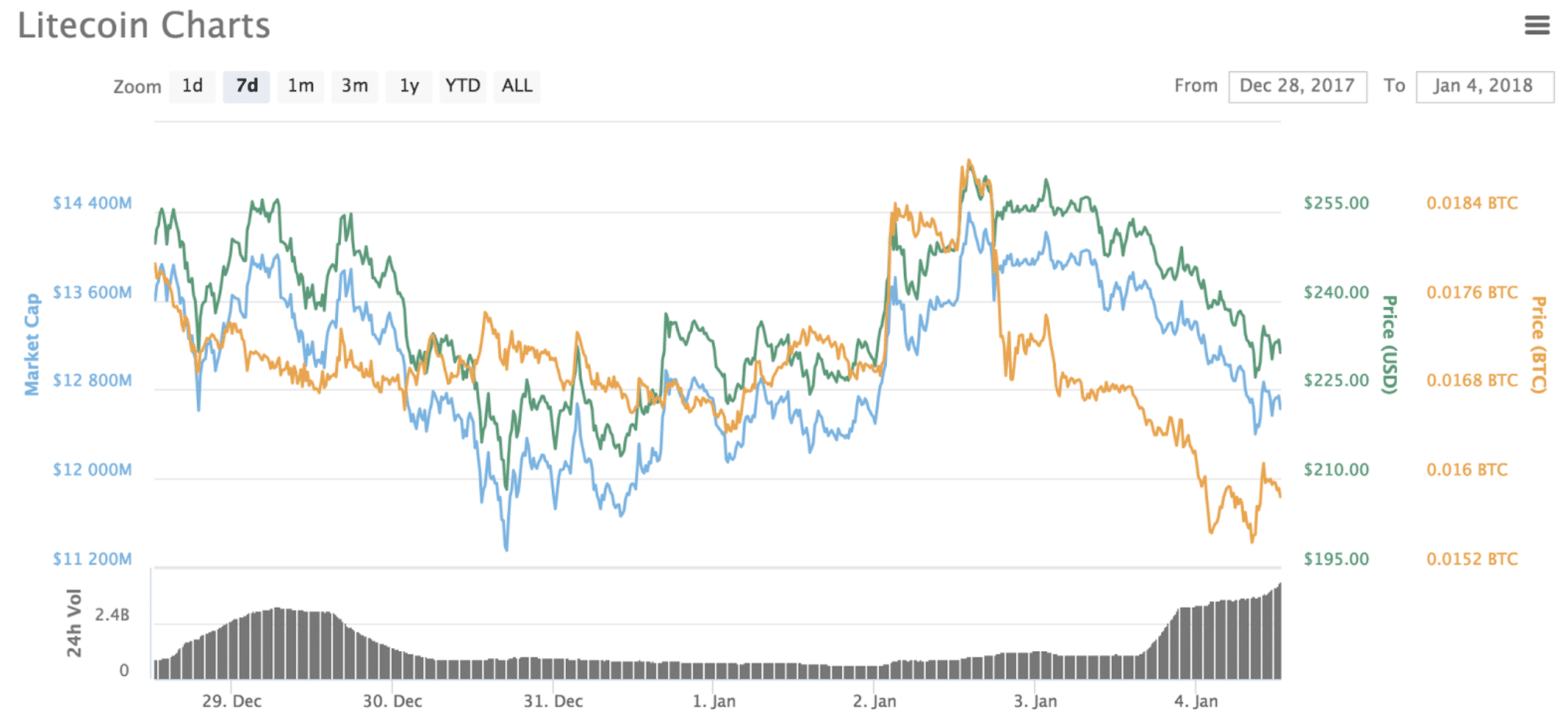

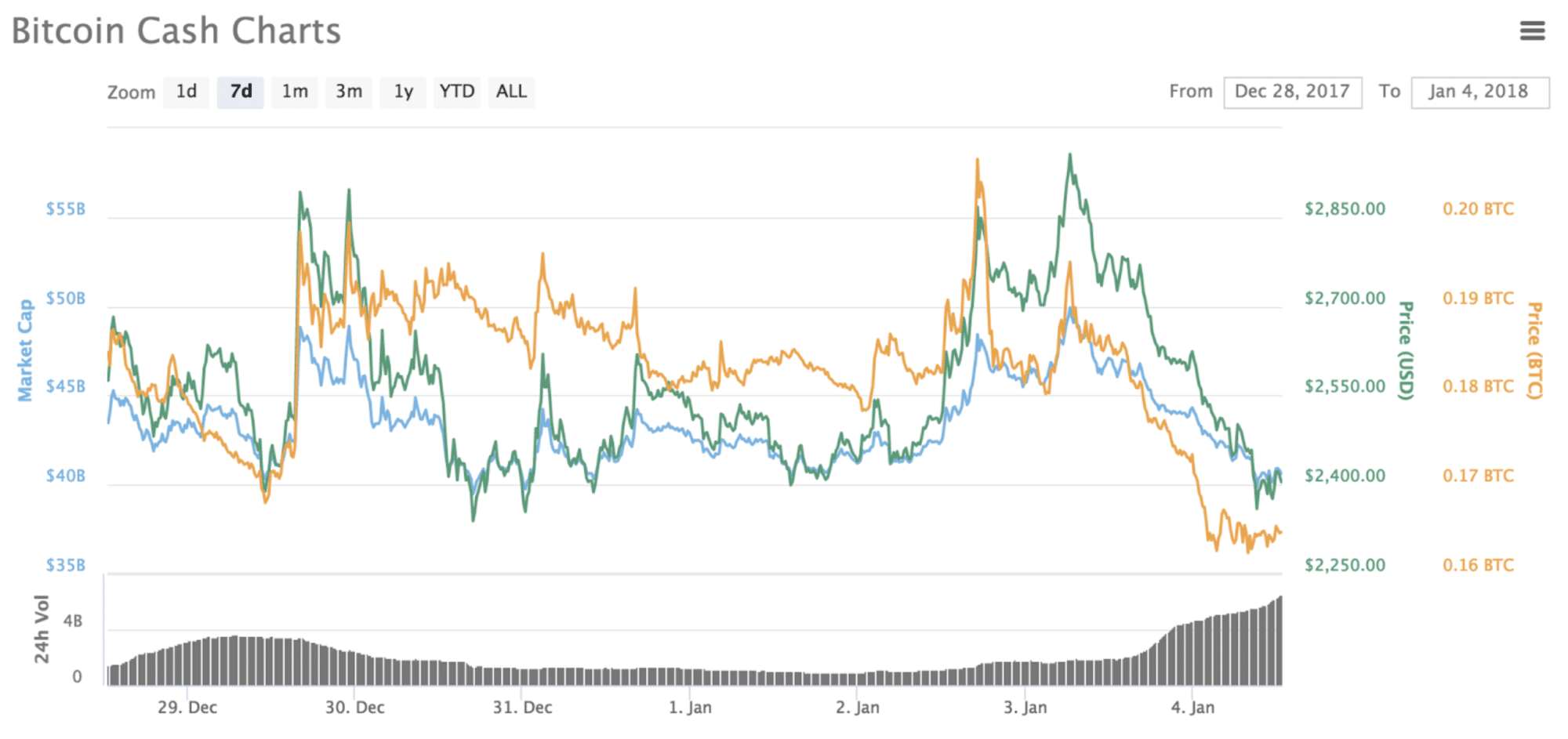

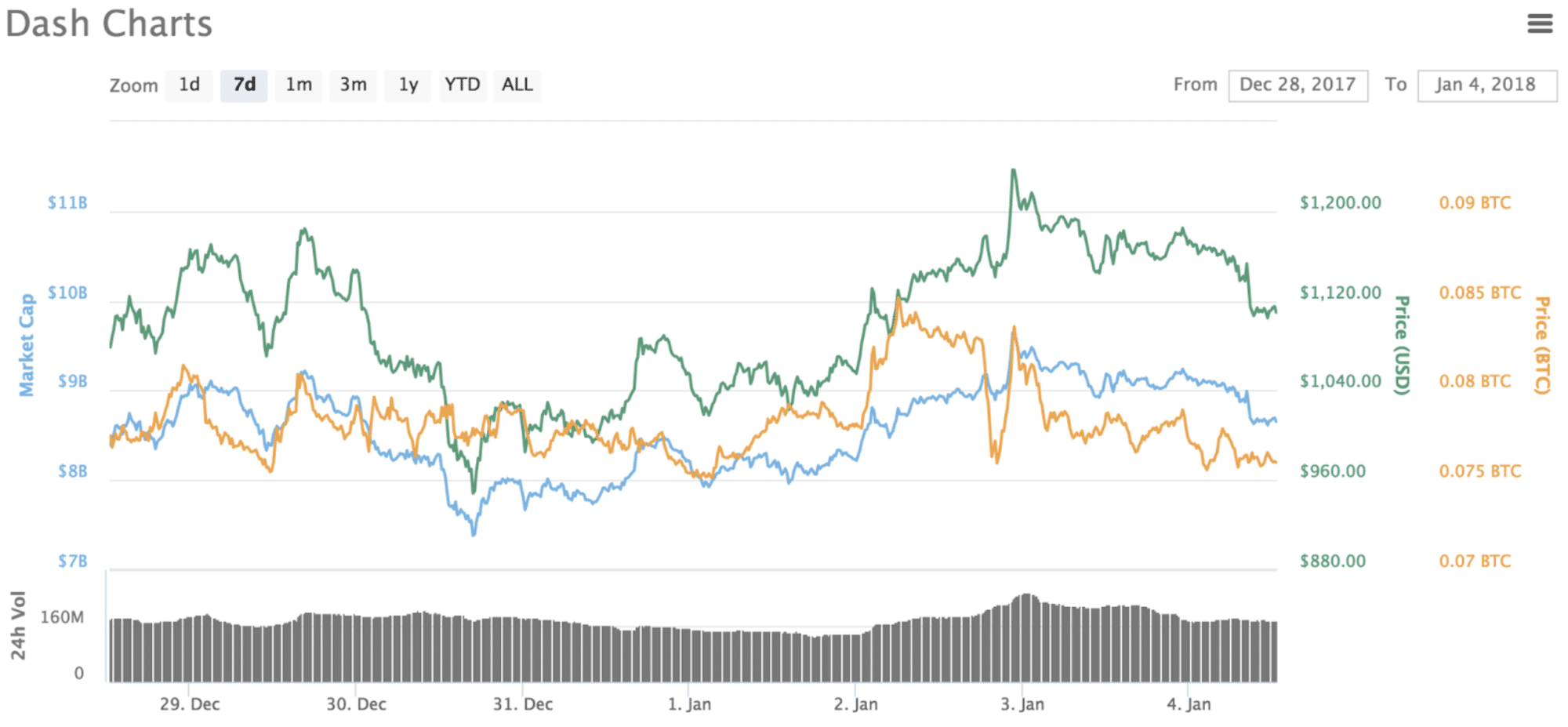

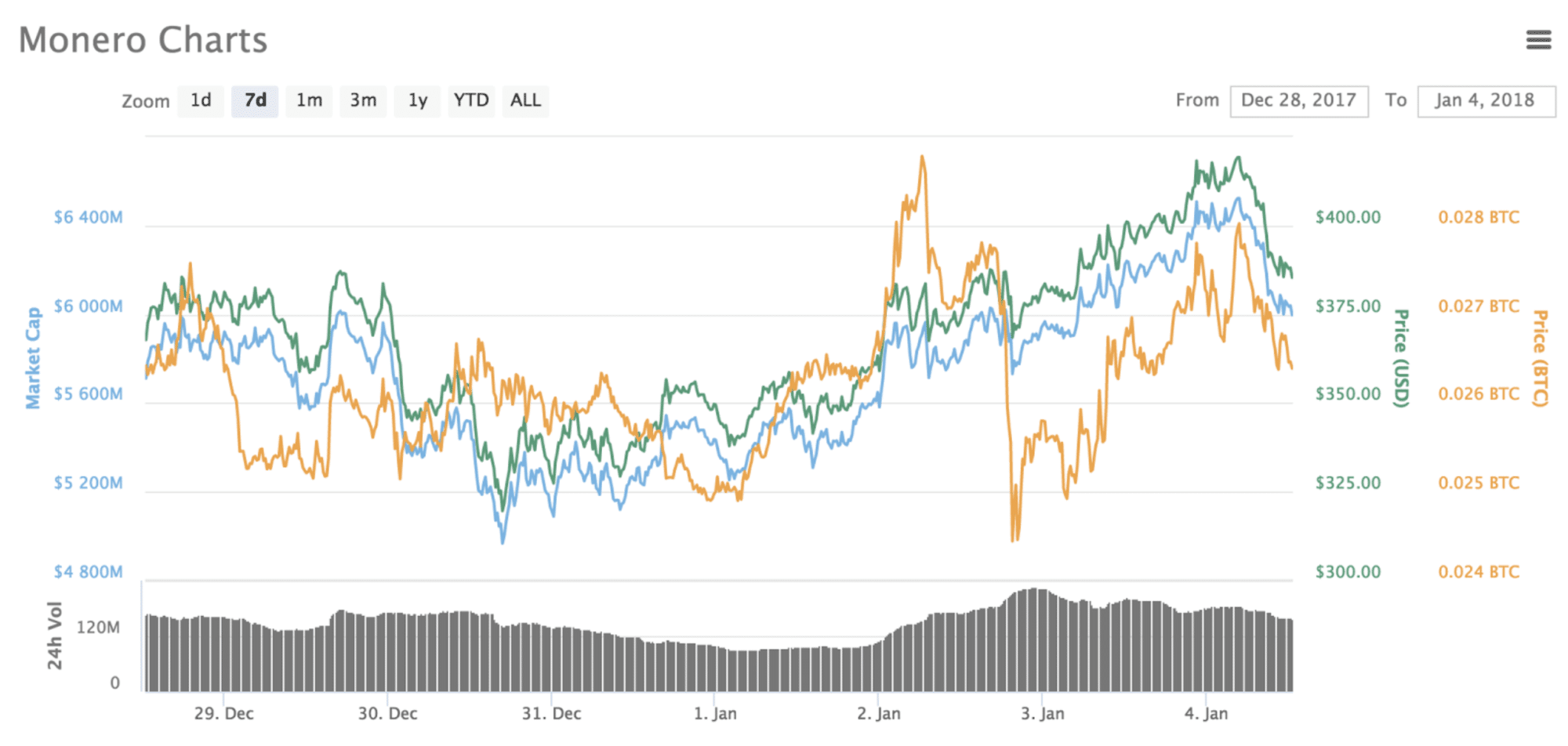

There are myriad examples of cheap coins on the rise. Compare these charts to those of the more expensive coins which saw great success in 2017, but struggled this past week.

There’s no significant news surrounding many of these cheaper coins. Yet they’re pumping, and the total market cap is inflating. In the case of Cardano, they don’t even have a working product yet.

It’s reasonable to believe this is a case of new money making its way into the altcoin market, disregarding maximum supply of coins and market caps, and simply hoping to cash in on the crypto mania. People psychologically see coins at one dollar to have great growth potential and a coin at 200 dollars to have less.

“There is evidence that investors fail to properly adjust their reference point” when it comes to the price of these coins and the total supply. (The Psychology of Investing by John R. Nofsinger)

The reality is that the one dollar coin could be vastly overvalued and the 200 dollar coin completely undervalued. It will be interesting to see if these recent gains seek safe haven and eventually flow into coins with a more proven track record. Or perhaps we have entered into a new era, the rise of the cheap coin.

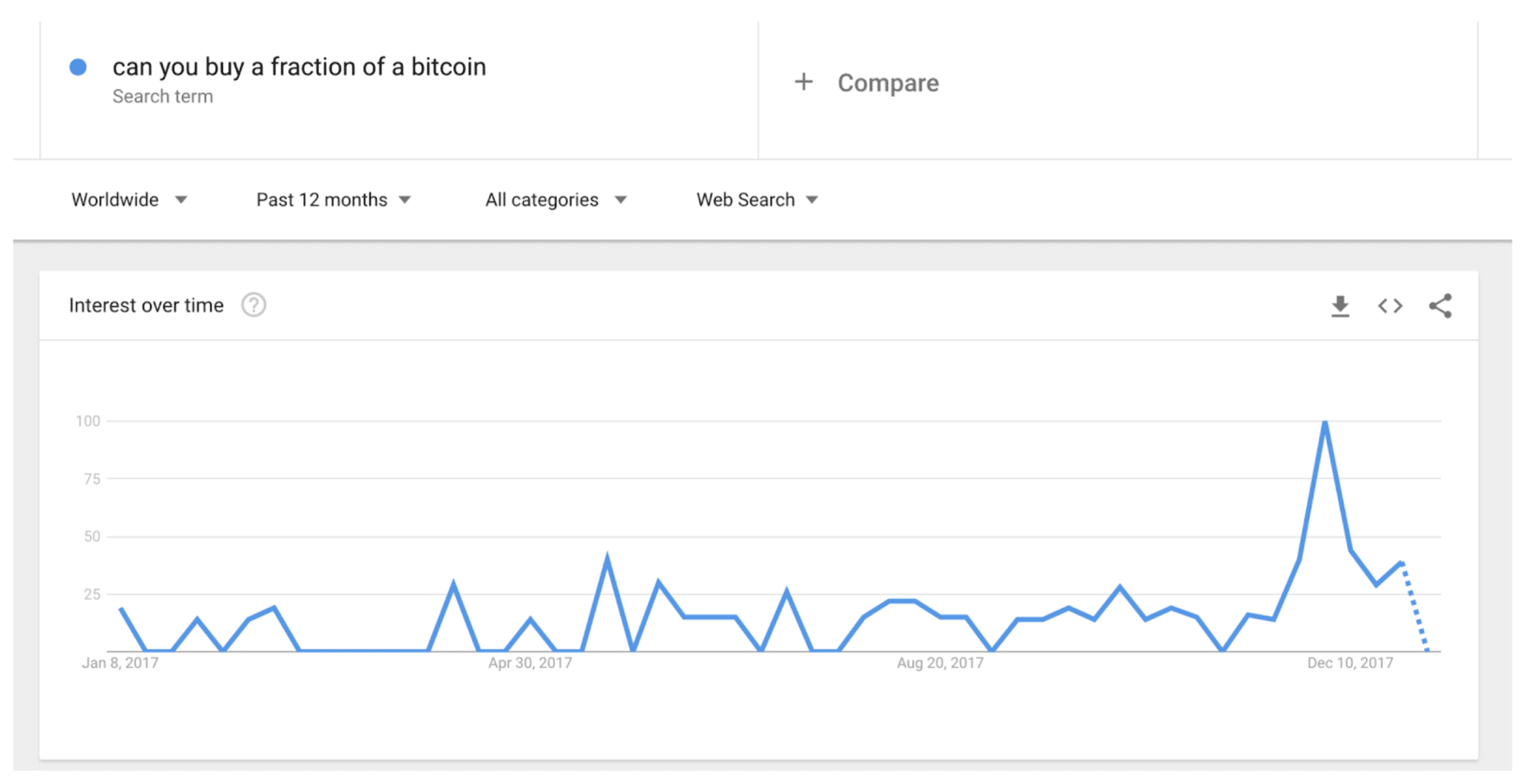

Up until recently, it was still possible for the average person joining Coinbase or some other exchange to buy integer values of BTC, ETH, and LTC. Many people still don’t understand that you can buy a fraction of a Bitcoin.

But even if someone knows Bitcoin is different from a stock, “understanding fractions and decimals is difficult because whole numbers are the most frequently and earliest experienced type of number”. Also consider that “mounting evidence suggests that consumers’ desire to deal in clean, round numbers”. Due to the growth of these coins, though, buying integer values is no longer feasible for the average investor.

In 2017, Bitcoin saw tremendous growth of 1263% and received the most press coverage. Following along with the psychological effect of these cheap coins, it’s no surprise that Litecoin outperformed Bitcoin on the year with 4978% growth. Did the people buying into Litecoin have knowledge of Charlie Lee, transaction times, fees, and lack of constant hard forks? It’s no coincidence that Litecoin was by far the cheapest coin to purchase directly from fiat on the more popular exchanges in America and China in 2017. People may have been psychologically intimidated by the four-figure price of Bitcoin, but with Litecoin, they felt they were getting in on the ground floor and that there was still hope for 5000% gains.

Now we come to 2018 where Bitcoin, Ethereum, and Litecoin still remain the easiest coins to purchase, but they are losing their dominance of the market, being threatened by the up and coming cheap coins. Clearly more and more money is moving into the market each day, but for those starting out, we are seeing the cycle continue, with Litecoin consistently over 200 dollars, a search for the new cheap coin begins.

Investing conversations these days typically go as follows:

Person A: You should get into the crypto market, it’s not too late.

Person B: Yea but all the coins you own are too expensive. I want something cheap. Name me any cheap coin that people have heard of.

Person A: Well, there is Ripple. It’s about 50 cents, but there are billions of them, so its market cap is already quite high.

Person B: 50 cents? Yes, I want that. I want any coin that is still cheap. I can own 20,000 of them!

This conversation isn’t uncommon and is indicative of what’s going on in the crypto space.

Of course, Ripple goes up 640% shortly after. Ripple is the poster boy for the psychological advantage of cheap coins and perhaps opened the floodgates. Many people originally became interested in Bitcoin as a way to circumvent the banks, and now we have Ripple, #3 in market cap, wanting to work directly with the banks. Not only is their coin centralized, pre-mined, with 20% of the wealth going straight to the creators, but the token has nothing to do with their attempted business with the banks. It has even had its own articles on CNN recently. Has this coin simply increased because it has exposure and is cheap? It’s possible the casual investor is putting little time into understanding the difference between the 21 million maximum supply of Bitcoin versus the 100 billion maximum supply of Ripple or the comparison of market caps.

As the average cryptocurrency holder matures, and the dopamine rush of the BTC, ETH, and LTC moons wears off, a greater percentage move into the world of Binance and Bittrex, searching for that next big pump. Here’s where the cheap coins have started to thrive. As for which cheap coins, in particular, are increasing? There’s certainly some correlation going on with the exposure they receive on Reddit and Twitter.

Possible Rebranding

Now let’s see what Litecoin has already done to tackle the cheap coin space. The Loaf Wallet has tried to help move away from Litecoins and focus more on Lites (where 1 ltc = 1000 lites), with a new default setting showing the total number of Lites in your wallet. Imagine if when you log in to Coinbase, the intimidating 200 dollar Litecoin is gone and a nice 20 cent Lite is available instead.

Finally, and most importantly, there are strong rumors recently that Coinbase and other exchanges will make a coordinated effort to brand the idea of a Bit (where perhaps 1 btc = 1000 bits). There are still many people that want to be a part of Bitcoin but find the price daunting. If these people log in and see they can buy bits for 15 dollars, it could lead to billions flowing into Bitcoin and any other coin that can successfully execute this strategy.

A psychological rebranding would also help in the long run with the actual spending of the coin. Though some websites try, it’s simply not feasible on a mass market level to list the prices of goods in your store as 0.00300000 BTC. That will be 3 bits please.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.